By Sami Zaptia.

Tripoli, 9 July 2014:

An expanded meeting was held by the Libyan government yesterday on resolving the problems of financing . . .[restrict]the 2014 budget.

The government was keen to exchange views and study various possible solutions to resolve the bottlenecks caused by the delay of the passage of the 2014 budget, as well as the anticipated deficit.

The delay in the passage of the 2014 budget, which was presented by the then Ali Zeidan led government in January this year, had been caused, on the one hand, by both the political upheaval regarding the removal of Prime Minister Zeidan by the GNC, and public pressure to remove the GNC itself.

On the other hand, the delay was also caused by the decline in Libya’s oil revenues to less than an average of 300,000 bpd, caused by the blockade of Libya’s oil ports by the Federalist Ibrahim Jadhran.

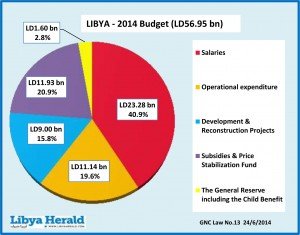

The LD 56.95 bn 2014 budget was approved by the outgoing GNC on 22 June, however, the Central Bank of Libya (CBL) has referred it to its legal department for an opinion. In the meantime, the CBL has declared that it will only disburse the wages and subsidies sections of the budget, pending a legal decision.

The meeting, headed by Caretaker Prime Minister Abdullah Thinni, included the head of the Audit Bureau, the Deputy Governor of the CBL, the Ministers of Finance, Planning, Transportation, Oil and Gas, as well as a number of department managers.

The discussions revolved around the deteriorating financial and security situation in the country and the effects of the economy, finances and security on one another.

In reviewing the various possible solutions available, the meeting decided to consider the following options:

1- The opening of a Single Treasury Account (STA) for government accounts.

2-The financing of the budget deficit through the issue by the Libyan government of Treasury bonds or Islamic bonds (Sukuk)

3- The rationalization and reduction of state spending.

4-A review of legislation on previous spending decisions

5-The use of chapter three (Development/construction section) of the budget to partially make up the budget deficit.

The meeting also decided to form two committees, the first to consider the idea of the issuing of government bonds and the second to study the option of Islamic bonds (Sukuk).

The creation of a Single Treasury Account (TSA) is one of the areas that both the IMF and the World Bank have been helping Libya with as part of the Public Finance Management (PFM) improvements that they offer – as part of the Technical Assistance agreements in place with Libya.

A treasury single account (TSA) is deemed an essential tool by the IMF and World Bank for consolidating and managing government cash resources.

In countries with fragmented government banking arrangements such as Libya, the ministry of finance/treasury lacks a unified view and centralized control over government cash resources. As a result, this cash often lies idle for extended periods in numerous bank accounts.

Establishing a unified structure of government bank accounts through a TSA helps solve these problems, improving cash management and control, as well as reducing corruption. The creation of TSA is usually considered a priority in the public financial management (PFM) reform agenda advised by the IMF and World Bank.

A TSA also facilitates better fiscal and monetary policy coordination as well as better reconciliation of fiscal and banking data, which in turn improves the quality of fiscal information. Finally, the establishment of an effective TSA significantly reduces the debt servicing costs.

With regards to the issue of Libyan government bonds, it will be recalled, however, that the Grand Mufti, Sheikh Sadik Al-Ghariani, had earlier this month forbidden the Central Bank of Libya and Libyan state-sector officials from accepting any interest-bearing loans to support the 2014 budget deficit.

This prohibition is in line with Libya’s decision to ban all interest-bearing loans from banks by January 2015.

On the issue of rationalization and reduction of state spending, the 2014 budget had already forced five major reform measures upon the government in the hope of controlling the rampant deficits accumulated since the 2011 Revolution

These are: the use of the National ID Number as a precondition of all budget disbursements, a wage freeze on all state sector wages in 2014, reform of the rampant subsidy system, the reduction of all non-essential imports and the prohibition of the signing of any new contracts by the Caretaker government.

The use of the chapter three section of the budget, which consists of LD 9 bn or 15.8 percent of total budget allocated for development and construction to partially make up the budget deficit, is unfortunate, but expected.

Using the development/projects section is the easiest solution politically for the government. Ali Zeidan sought and received special dispensation from the GNC in order to use the chapter three allocations to pay for wages when the oil ports embargo throttled state revenues.

While it is a good short term solution for the desperate government to pay wages, subsidies and the various demands of the 2014 budget until oil exports rise to early 2013 levels, it is bad news for development and construction.

It means that many new (minor) infrastructure and maintenance needs as well as equipment, tools and machinery needed in various sectors will probably be postponed until 2015.

It is also bad news for all the various foreign construction companies owed money by Libya, as it means it leaves no money in the budget for the repayment of debts – let alone new projects.

[/restrict]